The Banking and Financial industries are data-driven sectors of the economy. High-volume data and the highly regulated market made it necessary for these industries to embark on the journey of digitization. Today, with the help of automation technologies, the industries are evolving faster than ever before. Banks and financial services are rapidly adopting technological innovations in an attempt to develop and improve the overall industry. Let’s learn more about the impact of automation on the finance and banking sector.

What is Business Process Automation?

Business process automation is also referred to as BPA, business automation, and digital transformation. It is the procedure of managing and handling business processes with the help of technology-driven automated processes. It allows replacing the manual, time-consuming, and costly methods of performing tasks with automated systems that provide enhanced accuracy which may not be possible when humans perform the tasks. They are designed to increase the key productivity of business processes with the help of computing software and technology.

Business Process Automation has become an emerging trend in many top industries because of its ability to simplify complex and redundant tasks, enhance service quality, improve efficiency, reduce overall operation costs, achieve targets faster, and accomplish digital transformation. Not only that, BPA helps in improving business workflow as well. In addition to achieving higher efficiency levels, BPA is being widely implemented as a part of bigger business strategy in order to adapt to the changing industry needs, reducing chances of human error, and redefining job roles and responsibilities.

Today, BPA is being implemented in all sorts of industries such as healthcare, automobile, gaming, education, aviation, and retail. Meanwhile, the finance and banking industry is experiencing quite an impact. With the help of these strategies, BPA can manage various aspects of banking sectors such as customer relationships, sales, workflow, compliance, planning, and more. Today, it has emerged to become one of the most important strategies used by modern businesses.

It is important to note that BPA toolset may vary from process to process. It goes beyond a traditional data management system to highly sophisticated software systems. Among many other technologies, Artificial Intelligence is one of the most prominent technologies being used for business automation, simply because of its ability to simulate human cognitive abilities, interpret unstructured data, interact with humans, and ability to be implemented without human intervention.

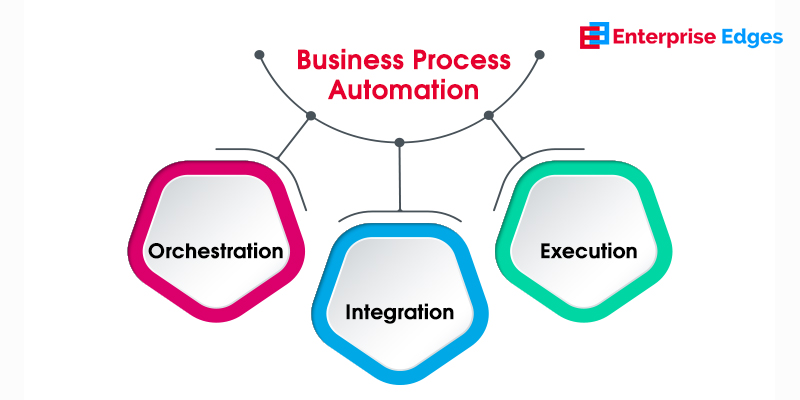

There are three fundamental principles of Business Process Automation. It includes:

a) Orchestration:

BPA enables every organization or enterprise to design their own systems based on their own needs and fundamentals.

b) Integration:

This means BPA is not restricted to a single department. Instead, it is spread across all the divisions of the companies with a common goal of focused performance and improved efficiency.

c) Execution:

This means that it reduces efforts and human intervention so that human employees can focus on important and complex tasks.

Difference Between Business Process Management and Business Process Automation

Business Process Management and Business Process Automation not only sound a lot alike but are also related in many ways. At the most basic level, BPA is about automating business processes; and BPM is about managing business processes. The latter may or may not involve intelligent automation.

More often than not, people are confused between the two concepts. However, BPM is larger and more elaborate process and BPA can be just a part of the big strategy that BPM is. Hence, BPA can be referred to as a form of BPM. Nonetheless, tools of BPA and BPM are usually deployed to achieve similar goals like improving efficiency, tackling workflow, reducing efforts, and ultimately achieve greater productivity.

Common uses of Business Automation in Banking and Finance

- Automate redundant, repetitive, and data-intensive tasks and activities

- Automate problem-solving

- Automate analytics

- Enforce industry policies and standardization

- Work in abidance of company rules and procedures

- Organize internal processes

- Enhance staff efficiency

- Comply with industry standards

- Reduce operational costs

- Lower overhead count

Business Process Automation in Banking

Artificial Intelligence, machine learning, and robotic process automation (RPA) are some of the automation technologies that have led to a seamless digital transformation of the banking sector. Blockchain and biometrics are some other new digital technologies that have proven to be transformative for banking business processes, such as:

1. Know your customer:

Customer information is of utmost importance for banking activities. Banks and financial services require customer information not only for opening the account but at various other stages. Usually, this information goes through banks’ internal processes that must ensure that it is within the regulatory compliance with various other agencies. In order to do so, several checks like identity verification and background checks are implemented. If banks have to go through this step-by-step every time they open a new account or approve a loan, then this could prove to be a monumental task. This is where intelligent automation in banking sector comes to play. Automated systems are used to create a centralized network of information that can push and pull information easily. Using machine learning, these systems can extract information in whatever format they exist.

2. Core banking operations:

Several automation technologies when introduced as a part of BPA is changing different aspects of back-office banking operations such as customer data updates, verification, documentation, accounting reconciliation and more.

3. Compliance and risk analysis:

Audits are an inherent part of banking operations. Therefore, banks are significantly investing in automation technologies to improve and automate the business processes that are involved in risk and compliance. Not only do these automation technologies promise to improve the various processes, but they also have greater adaptability when compared to IT platforms. This makes it easier for banks to perform fraud checks, quality checks, risk reporting, and more.

4. Credit Card Processing:

Gone are the days when you had to wait for weeks before your credit card was approved. The long wait is over with business process automation and automation technologies that are now helping banks in processing the applications within hours by accessing multiple systems to validate information, perform a background check, and more.

5. Mortgage Loan:

Technological transformation has amped up the mortgage loan systems. The process of approving a mortgage loan took more than 60 days before automated processes were initiated. Now, going through checks, history, employment status, and other required processes is easier and simpler. Technology has accelerated the procedure to reduce the processing time.

6. Customer Service:

Customer service is one of the top priorities of banks these days. With enormous competition in the banking industry, banks are constantly striving to provide enhanced customer experience to their clients. Automation technologies help them achieve the same tremendously. For example, responding to thousands of queries daily is difficult for banks, however, automation allows them to provide the best possible solutions at the earliest, and sometimes in real time. It has drastically reduced turnaround time.

7. Fraud detection:

With digitization, concerns about fraud and terrorist activities in banks has increased. However, Robotic process automation, one of the many automation technologies, allow fraud prevention using predictive analysis and stops a disastrous breach.

In addition to all of this, business process automation is improving several other aspects of banking such as account origination and receivable, collection, general ledger, underwriter support, account closure process, and more. Banks can do a lot more with business process automation than ever before. Let’s take a look at some of the many benefits of automation in the banking sector.

Intelligent Automation in Banking and Finance Industry

1. Cost savings:

The primary reason why banks and financial services are deploying tools of BPA is to save money. There is no doubt that automation improves efficiency, enhances speed and eliminates human error, but it also contributes to saving money. Experts suggest that the use of automation can reduce up to 90% operational costs. Surveys suggest that implementing RPA alone has enabled banks to save up between 25% to 50%.

2. Accelerating operational efficiency:

Time and again we have mentioned how automation can reduce time and effort spent on routine jobs at the banks. Tasks like report analysis, tracking compliance, documentation, software updates, reconciliation and so much more are the most challenging tasks in banking and financial services. So, automating processes is one way the banks can optimize their efficiency. In turn, it allows the employees to perform higher-value tasks that require decision making, problem-solving, providing customized products and services to the clients. At first, tools of BPA seems to be an extensive process that requires training, skill formation, setup, and supervision. However, when implemented properly, the impact is incredibly impressive.

3. Leveraging existing infrastructure:

The best part about the automation technologies is that it does not require a new setup altogether. Most of them can be implemented without disrupting the existing structures. They can be integrated with as many systems making it effective department-wide.

4. Real-Time Data Processing:

What makes banking and financial services challenging is extensive processing of data and analyzing unstructured and structured data. AI and machine learning enable real-time data processing that has reduced workload and leaves no room for human errors. Trade monitoring, risk management, and intelligent cash management are some of the aspects of banking and financial services that have impressively benefited from it.

5. Enhanced Customer Experience:

Over the years, banks have become customer-centric and they are dedicated to catering to customer’s diverse needs to optimize their financial health. Modern technologies provide them the opportunity to analyze customer history, behavioral patterns, preferences, and enable them to improve their wealth management and investment advisory divisions. Using robo-advisors and chatbots, they are interacting with customers to provide assistance in even the most complex issues.

With so many benefits, banks are adopting intelligent automation rapidly. It helps banks stay ahead in the competition and relevant in the market that is flooded by emerging financial technology and innovations. Along with that, it is one of the biggest contributors to the significant growth of the business.